2020 was pretty exceptional. We were confronted by a global pandemic that we were unprepared for. After an initial setback, our companies that were part of the digital economy experienced exponential growth and were barely holding it together, while our companies grounded in the real, physical, world had to grind it out, riding the wave of COVID surges around the world – hope and pessimism in a regular beat.

2021 has been frenetic. The global money printing presses have fuelled an investment boom the likes of which we’ve never seen before. Past booms look like mini booms compared to this. Reflecting on the state of the New Zealand venture capital market pre to 2020, Movac was the only New Zealand fund of modest scale ($100m+). In 2017 I wrote a blog reflecting an aspirational goal of creating a NZ VC eco-system made up of at least 3 VC funds investing $100m – $150m. Well, this is where we are today:

- Movac $250m

- GD1 $130m

- Icehouse Ventures $110m

- Nuance Ventures $55m

- Finistere Aotearoa Fund $40m

- Punakaiki Fund $65m (at most recent valuation)

- Pacific Channel $55m

- Blackbird NZ Fund $60m

And every week we pick up an announcement of a new fund coming to market. Congratulations to all the folks behind each of these for funds for getting to this point – it’s tough – and apologies if I’ve missed anyone.

Outside of this group we’ve seen numerous Australian, US and European funds make significant, and in some cases multiple investments, into New Zealand companies.

It looks like I undershot back in 2017 and venture investment in Aotearoa is in great shape as we exit 2021. All this activity means that the game has fundamentally changed in 2021:

- FROM a constrained venture capital market TO a booming venture capital market.

- FROM a market with limited investor competition TO investors competing to get into deals.

- FROM investors setting terms TO entrepreneurs setting terms.

- FROM deals taking months to complete TO deals completing in a month.

- FROM companies constrained by capital TO companies trying to figure out how to spend significant capital.

- FROM an employment market where it was relatively easy to find mid-tier talent TO companies fighting each other for talent (a zero-sum game for NZ inc., FYI)

So, the market we are now operating in is one that is thriving on innovation and owned by entrepreneurs! This is the best time we’ve ever seen to start a business in Aotearoa, New Zealand. But, it’s also a time for investors to be a little more cautious, a little more judicious. We’re all searching for the crystal ball to try and understand how markets will play out over the next few years. If markets don’t hold through this cycle there will be some challenging times.

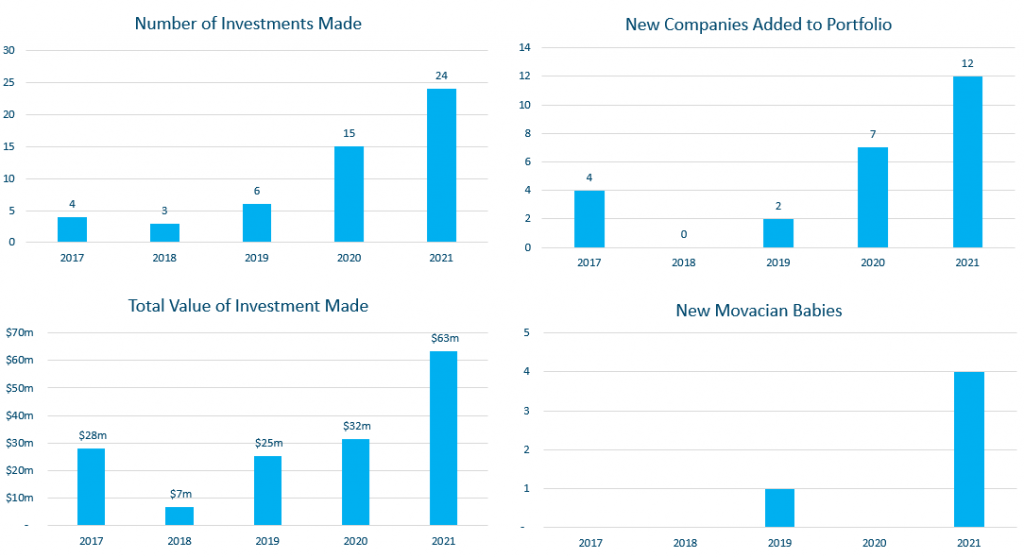

Consistent with this general market movement, for Movac 2021 has been our biggest year ever, by quite some margin. The charts below highlight how the activity has been building for us over the last 5 years.

We’re thrilled to be backing an additional 12 New Zealand tech companies this year on top of the 7 we added last year. And we were also a little sad but incredibly proud to say farewell to Unleashed, Vend, Timely, Coretex, and Aroa Biosurgery. Each one of these companies is now continuing its growth journey as part of a multi-national company or as a publicly listed entity. And then to add some real excitement into the mix 4 new babies were produced by the Movac team. 24 investments, 5 divestments and 4 new humans, phew!

Delivering on this level of activity has been a huge effort by the founders, their teams, our team and our investors. I want to acknowledge the courage and commitment that it takes to deliver these sorts of outcomes. We are looking forward to celebrating all that has been achieved this year over the break, and are very much looking forward to a big 2022.

From all the Movac team we wish you all the best for Christmas and the new year.

Ehara tōku toa I te toa takitahi.

He toa takitini tōku toa

(my strength is not due to me alone, but to the strength of many).